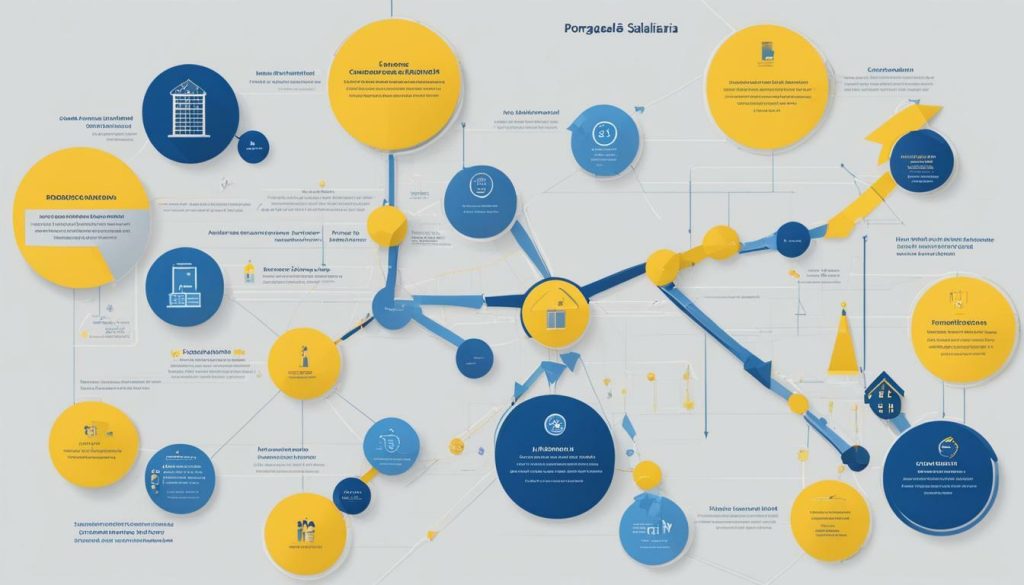

Welcome to our comprehensive guide on how to effectively utilize « portage salarial » when establishing your business in France. If you’re an American entrepreneur looking to venture into the French market, portage salarial can provide you with the benefits of employee status while allowing you to work independently. In this article, we’ll explore what portage salarial is, why you should choose it in France, and how it can help you integrate into the French business culture. We’ll also provide insights into the incorporation and registration process, the legal framework and regulations, choosing the right portage salarial provider, accounting and taxation considerations, health insurance coverage, and more. Let’s dive in!

- Portage salarial allows freelancers in France to work independently while enjoying employee benefits.

- A portage salarial company acts as the employer, taking care of tax and administrative obligations.

- Workers receive monthly salaries, are covered by professional insurance and unemployment insurance, and contribute to the employee pension scheme.

- Invoicing can be done before tax, gross salary, or net salary, with social security contributions considered in the calculation.

- Portage salarial simplifies accounting, taxation, and social security contributions compared to micro-enterprise status.

Keep reading to discover more about portage salarial in France and how it can benefit your business establishment journey.

What is Portage Salarial?

Portage salarial, also known as an umbrella company, is a system in France that allows freelancers to work independently while enjoying the benefits of employee status. It provides a unique business model that combines the freedom of self-employment with the security and advantages of traditional employment.

Under the portage salarial system, freelancers collaborate with a portage salarial company that acts as their employer. This company takes care of administrative tasks such as invoicing, tax obligations, and payments, allowing freelancers to focus solely on their work without the burden of administrative responsibilities.

Workers in the portage salarial system receive their salaries monthly and enjoy the same benefits as regular employees. These benefits include professional insurance coverage, unemployment insurance, and access to the employee pension scheme. Additionally, portage salarial workers can benefit from employment contracts that facilitate housing or bank loans.

The system also simplifies accounting, taxation, and social security contributions for freelancers. Invoicing can be done before tax, gross salary, or net salary, with social security contributions included in the calculation. This eliminates the complexities often associated with running a micro-enterprise and allows freelancers to focus on their core work.

| Advantages of Portage Salarial |

|---|

| Allows freelancers to work independently with the benefits of employee status |

| Removes administrative burden by outsourcing tasks to the portage salarial company |

| Provides professional insurance coverage, unemployment insurance, and access to the employee pension scheme |

| Simplifies accounting, taxation, and social security contributions |

« Portage salarial offers freelancers the best of both worlds – the freedom to work independently and the security of employee benefits. »

What is Portage Salarial?

Portage salarial, also known as an umbrella company, is a unique system in France that allows freelancers to maintain their independence while enjoying the benefits of employee status. It is a popular choice for individuals seeking a flexible work arrangement that provides stability and security.

- Freedom and Independence: Portage salarial allows freelancers to choose their projects, clients, and work schedule, enabling them to work according to their preferences and expertise.

- Employee Benefits: By working through a portage salarial company, freelancers have access to employee benefits such as professional insurance coverage, unemployment insurance, and contributions to the employee pension scheme.

- Administrative Support: The portage salarial company takes care of administrative tasks such as invoicing, tax obligations, and payments, eliminating the administrative burden for freelancers and allowing them to focus on their work.

- Legal Compliance: The portage salarial system ensures that freelancers operate within the legal framework, adhering to tax regulations and social security contributions. This provides peace of mind and reduces the risk of legal issues.

Portage salarial offers a win-win situation for freelancers, providing the freedom and flexibility of self-employment while enjoying the benefits and support of traditional employment. It is a well-established and regulated system that has proven to be successful for many professionals in France.

Why Choose Portage Salarial in France?

Utilizing portage salarial in France offers numerous advantages, making it an ideal choice for American entrepreneurs looking to establish their presence in the country. Portage salarial, also known as an umbrella company, provides a unique system that combines the freedom of freelancing with the benefits of employee status. This arrangement allows entrepreneurs to focus on their core business activities while leaving administrative tasks and legal obligations to the portage salarial company.

One of the key advantages of portage salarial is the simplified accounting, taxation, and social security contributions. Freelancers under the portage salarial system do not need to maintain a separate accounting system or worry about complicated tax calculations. The portage salarial company takes care of all financial obligations, including invoicing and payments, ensuring that freelancers receive their salaries regularly and accurately.

Moreover, choosing portage salarial in France provides access to a comprehensive package of benefits. Workers are covered by professional insurance and unemployment insurance, providing financial security in case of unforeseen circumstances. Additionally, freelancers can contribute to the employee pension scheme, allowing them to save for their future while enjoying the flexibility of self-employment.

Advantages of Portage Salarial in France:

- Simple and streamlined accounting, taxation, and social security contributions.

- Regular and accurate salary payments.

- Professional insurance coverage and unemployment insurance.

- Access to employee pension scheme for long-term financial planning.

« Utilizing portage salarial in France provides a hassle-free experience for American entrepreneurs, allowing them to focus on their business while enjoying the benefits of employee status. »

By choosing portage salarial, American entrepreneurs can navigate the intricacies of establishing a business in France with ease. The system not only simplifies administrative processes but also facilitates integration into the local business culture. With the support and assistance provided by portage salarial providers, entrepreneurs can overcome language barriers, cultural differences, and legal challenges, ensuring a smooth transition and successful business establishment.

| Advantages of Portage Salarial | Benefits |

|---|---|

| Simplified accounting | Freelancers do not need to maintain a separate accounting system. |

| Taxation made easy | The portage salarial company takes care of tax calculations and payments. |

| Social security contributions | Freelancers contribute to the employee pension scheme and are covered by professional insurance. |

| Financial security | Access to unemployment insurance provides a safety net in case of unforeseen circumstances. |

Incorporation and Registration Process in France

Before starting your business in France, it’s essential to understand the incorporation and registration process required by the authorities. This involves several steps and procedures that need to be followed to ensure compliance with the legal framework and regulations.

The first step is to choose the legal structure for your business. The most common options for entrepreneurs in France are sole proprietorship (entreprise individuelle) or forming a company (société). Each has its own advantages and considerations, so it’s important to consult with legal and tax professionals to make an informed decision.

Next, you will need to register your business with the appropriate authorities. This includes obtaining a unique identification number (SIREN) from the Commercial Court or the Chamber of Crafts and Small Businesses, depending on the nature of your business. You will also need to register for taxation purposes with the relevant tax authorities.

Additionally, depending on the nature of your business, you may need to obtain specific permits or licenses. This could include professional qualifications, health and safety requirements, or specific industry regulations. It’s important to research and comply with any industry-specific regulations to ensure the smooth operation of your business.

Table: Incorporation and Registration Process in France

| Step | Description |

|---|---|

| Choose legal structure | Decide whether to establish a sole proprietorship or a company. |

| Register with authorities | Obtain a unique identification number (SIREN) and register for taxation purposes. |

| Obtain permits or licenses | Research and comply with any industry-specific regulations or requirements. |

By following these steps and ensuring compliance with the incorporation and registration requirements in France, you can establish a solid foundation for your business. It’s important to seek professional guidance to navigate the complexities of the process, as this will help you avoid any legal or administrative pitfalls.

Legal Framework and Regulations of Portage Salarial in France

To ensure compliance and smooth operations, it is vital to have a clear understanding of the legal framework and regulations surrounding portage salarial in France. Portage salarial, also known as an umbrella company, is a system that allows freelancers to work independently while enjoying the benefits of employee status. It is governed by specific laws and regulations that protect both the workers and the clients.

Under the French law, portage salarial companies act as the employer for freelancers, handling tax and administrative obligations, invoicing, and payments. This arrangement provides freelancers with the security of employee benefits, such as monthly salaries, professional insurance, and unemployment insurance. They also contribute to the employee pension scheme and may have access to employment contracts for housing or bank loans.

In terms of invoicing, portage salarial offers advantages over micro-enterprise status, simplifying accounting, taxation, and social security contributions. Invoices can be issued before tax, gross salary, or net salary, and it is important to consider social security contributions in the calculation. The gross salary includes employee social contributions, while the net salary is the amount received after deductions.

Table: Comparison between Micro-Enterprise and Portage Salarial

| Aspect | Micro-Enterprise | Portage Salarial |

|---|---|---|

| Employee benefits | No | Yes |

| Accounting complexity | High | Low |

| Taxation and social security contributions | Managed independently | Handled by the portage salarial company |

| Insurance coverage | Varies | Professional insurance and unemployment insurance provided |

Compliance with the regulations is essential to avoid legal issues and ensure a successful business operation in France. It is recommended to seek professional advice and choose a reliable and experienced portage salarial provider to navigate the legal framework effectively.

By understanding and adhering to the legal framework and regulations of portage salarial in France, American entrepreneurs can confidently venture into the French market, enjoying the benefits and support that come with this business model.

Integrating into French Business Culture with Portage Salarial

Utilizing portage salarial can provide a smoother transition for American entrepreneurs looking to integrate into the unique French business culture. This innovative business model allows freelancers to work independently while enjoying the benefits of employee status, making it easier to navigate the intricacies of the French market.

One of the key advantages of portage salarial is its ability to provide entrepreneurs with a ready-made support network. By partnering with a portage salarial company, you gain access to a team of professionals who can assist with administrative tasks, invoicing, and payments. This support allows you to focus on building your business and establishing relationships within the French business community.

Furthermore, portage salarial offers the opportunity to collaborate with local experts who understand the nuances of the French market. These professionals can provide valuable insights and guidance, helping you navigate cultural differences and adapt your business strategy to fit the local context. Their experience and networks can be invaluable in establishing your presence and building successful partnerships in France.

Utilizing portage salarial can provide a smoother transition for American entrepreneurs looking to integrate into the unique French business culture.

Building Relationships and Networking

Building strong relationships is essential in French business culture. Networking events, business lunches, and after-work drinks are common ways to connect with potential partners and clients. Joining industry associations and attending trade fairs can also help you establish credibility and expand your network.

With portage salarial, you can take advantage of networking opportunities organized by your chosen provider. These events bring together professionals from various industries, providing a platform for you to showcase your expertise and make valuable connections. Additionally, your portage salarial company can introduce you to its existing network of clients and partners, opening doors to potential collaborations.

Understanding Etiquette and Communication

Familiarizing yourself with French business etiquette is crucial for successful integration. French professionals value politeness, professionalism, and respect for hierarchy. Addressing individuals using their titles, engaging in small talk, and using formal language are all considered essential in business settings.

When working with a portage salarial company, you can benefit from their knowledge of French business etiquette. They can provide guidance on appropriate communication styles, assist with translating or adapting your business materials, and help you navigate cultural nuances to ensure your interactions are respectful and effective.

By utilizing portage salarial, American entrepreneurs can overcome the challenges of integrating into the unique French business culture. This innovative business model provides the necessary support, expertise, and guidance to establish a successful presence in France. With the right portage salarial provider by your side, you can confidently navigate the intricacies of the French market, build valuable relationships, and thrive in the dynamic business landscape.

Choosing the right portage salarial provider is crucial for a successful business venture in France. A reliable provider will offer comprehensive solutions that streamline administrative processes and ensure compliance with legal and regulatory requirements. Here are some factors to consider when selecting a portage salarial provider:

- Experience: Look for a provider with a proven track record and extensive experience in the industry. An established company will have the knowledge and expertise to navigate the complexities of the French business landscape.

- Services: Evaluate the range of services offered by the provider. A reputable portage salarial company should handle tax and administrative responsibilities, provide professional insurance coverage, handle invoicing and payments, and offer support and assistance throughout the business establishment process.

- Network: Consider the provider’s network of clients and partners. A well-connected portage salarial company can open doors to potential business opportunities and provide valuable contacts within the French market.

- Reputation: Research the reputation of the provider by reading reviews and testimonials from other entrepreneurs. A positive reputation is indicative of reliable and trustworthy services.

- Support: Assess the level of support offered by the provider. Look for a company that offers personalized assistance and guidance, ensuring that you have a dedicated point of contact who can address any questions or concerns.

By carefully selecting a portage salarial provider that meets your specific needs, you can benefit from a seamless and hassle-free business establishment process in France.

Table: Comparison of Portage Salarial Providers in France

| Provider | Experience | Services Offered | Network | Reputation | Support |

|---|---|---|---|---|---|

| Provider A | 15 years | Tax and administrative support, professional insurance, assistance with incorporation and registration | Wide network of clients and partners | Positive reviews and testimonials | Dedicated support team |

| Provider B | 10 years | Invoicing and payment management, comprehensive legal compliance, access to networking events | Strong partnerships with industry experts | Highly regarded in the industry | 24/7 support helpline |

| Provider C | 5 years | Full suite of HR services, personalized guidance for business integration | Growing network of international entrepreneurs | Recognized for exceptional customer service | One-on-one coaching from experienced professionals |

Ultimately, the choice of a portage salarial provider will depend on your specific needs and objectives. Consider these factors carefully to ensure that you partner with a reputable and reliable company that can support your business venture in France.

Support and Assistance for Business Establishment in France

Various support services are available to help American entrepreneurs navigate the intricate process of business establishment in France. Whether you are looking for guidance on legal requirements, administrative procedures, or cultural integration, there are organizations and professionals dedicated to providing assistance tailored to your needs.

« I found the team at France Business Support to be invaluable in helping me through the incorporation process, » says John Smith, an American entrepreneur who successfully established his business in France.

« They provided step-by-step guidance on the necessary paperwork, explained the legal framework, and even connected me with local experts for tax and accounting matters. »

One of the key advantages of utilizing portage salarial is the support it offers in streamlining the business establishment process. Portage salarial companies act as a bridge between freelancers and the French market, ensuring compliance with local regulations and providing administrative support. They can guide you through the incorporation and registration process, help you understand and comply with the legal framework, and offer assistance in navigating French business culture.

To ensure you receive the best support and assistance, it is important to choose the right portage salarial provider. Look for companies with a strong track record, a comprehensive range of services, and a deep understanding of the French business environment. Consultation and personalized advice should be part of their offering, as they can help you assess your specific needs and propose tailored solutions.

| Support Services | Benefits |

|---|---|

| Legal and administrative guidance | Smooth incorporation process |

| Financial and accounting support | Simplified tax and expense management |

| Cultural integration assistance | Adaptation to French business practices |

| Networking opportunities | Connections with local professionals and potential clients |

| Access to additional resources | Guidance on insurance options, health coverage, and more |

By leveraging the support and assistance offered by portage salarial providers and other dedicated organizations, American entrepreneurs can navigate the complexities of establishing a business in France with confidence. From initial incorporation to ongoing administration, these services can save time, mitigate risks, and ensure compliance, allowing you to focus on growing your business and seizing the opportunities that France has to offer.

Accounting, Taxation, and Social Security Contributions with Portage Salarial

Understanding the accounting, taxation, and social security contribution requirements is essential when utilizing portage salarial for your business in France. Portage salarial, also known as an umbrella company, provides a simplified approach to managing these aspects, allowing freelancers to focus on their work without the burden of administrative tasks.

When working with a portage salarial company, your accounting needs are taken care of by the company itself. They handle invoicing, tax calculations, and payments on your behalf, ensuring compliance with French regulations. This eliminates the need for you to set up a separate accounting system and provides peace of mind knowing that your financial matters are being handled by professionals.

When it comes to taxation, portage salarial offers advantages over other business models. Your income is subject to income tax deductions at source, simplifying the process and ensuring compliance. Additionally, social security contributions are automatically deducted from your salary, covering your healthcare and pension benefits. This means that you can enjoy the benefits of employee status while working independently as a freelancer.

In terms of social security contributions, your portage salarial company takes care of ensuring that you are covered by professional insurance and unemployment insurance. These contributions are included in your gross salary, which is paid to you on a monthly basis. This ensures that you have the necessary protection and benefits while working on your projects.

Table: Accounting, Taxation, and Social Security Contributions Overview

| Aspect | Portage Salarial | Micro-Enterprise |

|---|---|---|

| Accounting | The portage salarial company handles invoicing and tax calculations. | You need to set up your own accounting system and manage invoicing and tax calculations. |

| Taxation | Income tax is deducted at source, simplifying the process. | You are responsible for managing your own income tax payments. |

| Social Security Contributions | Contributions are automatically deducted from your salary, providing healthcare and pension benefits. | You are responsible for managing your own social security contributions. |

By utilizing portage salarial, you can streamline your accounting, taxation, and social security contribution processes, allowing you to focus on your work and grow your business in France.

« Portage salarial has been a game-changer for my business in France. I no longer have to worry about accounting, tax calculations, or social security contributions. It allows me to focus on what I do best while enjoying the benefits of employee status. Highly recommended! »

Health Insurance Coverage for Portage Salarial Workers in France

Workers utilizing portage salarial in France enjoy health insurance coverage through the French health system, known as « assurance maladie » or Sécu. This system provides comprehensive health coverage to individuals, regardless of their citizenship. It is a social security health insurance scheme that ensures access to healthcare services and covers a wide range of medical expenses.

Under the French health system, portage salarial workers are entitled to medical consultations, hospitalization, prescription drugs, and various other healthcare services. The system is funded through social security contributions paid by both employers and employees, including portage salarial companies and workers. These contributions are calculated based on the worker’s income and are deducted from their salaries on a monthly basis.

In addition to the basic health coverage provided by « assurance maladie, » portage salarial workers can also opt for a voluntary top-up health insurance scheme called Assurance Complémentaire. This supplementary insurance provides additional coverage for expenses that may not be fully covered by the social security system. It includes benefits such as higher reimbursement rates for certain medical procedures, coverage for dental and optical care, and access to private hospitals.

Overall, the health insurance coverage offered through portage salarial in France ensures that workers have access to quality healthcare services and protects them from high medical costs. Whether they choose to rely solely on the basic « assurance maladie » coverage or opt for additional coverage through Assurance Complémentaire, portage salarial workers can have peace of mind knowing that their healthcare needs are taken care of.

| Benefits of Health Insurance Coverage for Portage Salarial Workers in France |

|---|

| Comprehensive coverage for medical consultations |

| Hospitalization expenses are covered |

| Prescription drugs are included |

| Access to a wide range of healthcare services |

| Option to choose a supplementary insurance scheme for additional coverage |

| Protection from high medical costs |

Taxation and Income Reporting for Portage Salarial Workers in France

Portage salarial workers in France must adhere to specific taxation and income reporting requirements as per the regulations. Understanding these obligations is essential for maintaining compliance and avoiding any financial penalties.

When it comes to taxation, portage salarial workers are subject to income tax deductions at source using the « pay as you earn » (PAYE) system. This means that taxes are withheld from their salaries before they receive them. It simplifies the process for workers, ensuring that their tax obligations are met without the need for separate filings.

To accurately report their income, portage salarial workers must keep detailed records of their invoices, expenses, and payments received. This information is crucial for calculating their taxable income and deductions. It is recommended to maintain a separate bank account for business transactions, making it easier to track income and expenses.

| Taxation Tips for Portage Salarial Workers |

|---|

| Keep organized records of all invoices, payments, and expenses |

| Ensure your expenses are properly categorized for tax purposes |

| Consult with a tax professional or accountant to understand your specific obligations |

Proper tax planning is crucial for portage salarial workers to ensure compliance with the regulations and optimize their tax position. It is recommended to consult with a tax professional or accountant who specializes in French taxation to receive personalized advice based on your unique circumstances.

Income Reporting for Portage Salarial Workers

In addition to taxation, portage salarial workers must also report their income to the appropriate authorities. This includes providing accurate information on their invoices and reporting their earnings on their annual tax returns.

It is essential to accurately calculate and report both your gross and net income. Gross income refers to the total amount invoiced to clients or received before any deductions, while net income is the amount received after deducting expenses and social charges.

Remember to keep all financial documents and records organized to ensure accurate reporting. By maintaining clear and detailed records, you can easily provide the necessary documentation if requested by tax authorities or auditors.

Complying with taxation and income reporting regulations is crucial for portage salarial workers in France. By staying informed and maintaining meticulous records, you can successfully navigate these obligations and focus on the growth and success of your business.

Portage salarial workers in France can benefit from expense reimbursement options and various deductions for tax and social charges purposes. Expenses incurred during business activities can be reimbursed by clients, allowing workers to recover costs associated with their work. These expenses can include travel expenses, meal expenses, office supplies, and other necessary expenses. When submitting invoices, it is important to clearly indicate the reimbursable expenses and provide supporting documentation to ensure smooth reimbursement processes. The ability to have these expenses reimbursed can significantly reduce the financial burden on portage salarial workers, making the business more manageable and cost-effective.

In addition to expense reimbursement, portage salarial workers can also take advantage of various deductions to optimize their tax and social charges obligations. Fixed expenses, such as business rent or utility bills, can be deducted from invoices, reducing the taxable amount. Variable expenses, such as marketing expenses or professional development courses, can also be deducted, further reducing the tax and social charges liability. It is essential to keep accurate records of these expenses and consult with a tax professional to ensure compliance with the regulations regarding deductions.

Table: Examples of Deductible Expenses

| Expense Category | Examples |

|---|---|

| Travel Expenses | Transportation, mileage, accommodation |

| Meal Expenses | Business meals with clients/partners |

| Office Supplies | Stationery, computer equipment, software |

| Marketing Expenses | Advertising, promotion, website development |

| Professional Development | Training courses, conferences, workshops |

By taking advantage of expense reimbursement and deductions, portage salarial workers can effectively manage their financial obligations while maximizing their disposable income. It is recommended to consult with a financial advisor or accountant to ensure compliance with the specific regulations and requirements of portage salarial.

Portage salarial workers in France are entitled to unemployment benefits when their contracts come to an end. This is one of the key advantages of using the portage salarial system, as it provides a safety net for workers transitioning between projects or seeking new opportunities.

Under the French labor law, portage salarial workers are considered salaried employees, which means they contribute to the unemployment insurance scheme. This contribution allows them to access unemployment benefits if they meet the eligibility criteria.

Unemployment benefits, known as « allocation chômage, » provide financial assistance to workers who have lost their jobs involuntarily. The amount of benefits received depends on various factors, including the worker’s previous salary and the duration of their employment. The benefits are typically paid for a limited period, giving workers time to find new employment or explore other opportunities.

It’s important for portage salarial workers to understand the process of claiming unemployment benefits in France. They need to register with the French unemployment agency, Pôle Emploi, and provide the necessary documentation to prove their eligibility. This includes proof of previous employment and the reason for contract termination. Once approved, workers will receive regular payments to support their financial needs during the job search.

Overall, portage salarial offers numerous benefits to workers in France, including the security of unemployment benefits. This makes it an attractive option for freelancers and independent professionals who want the flexibility of self-employment without sacrificing the stability of traditional employment.

| Benefits of Portage Salarial |

|---|

| 1. Combines the benefits of self-employment and employee status |

| 2. Simplifies accounting, taxation, and social security contributions |

| 3. Provides professional insurance coverage |

| 4. Enables access to unemployment benefits |

| 5. Offers flexibility and freedom in choosing clients and projects |

Conclusion

Utilizing portage salarial for your business establishment in France offers numerous benefits and can significantly contribute to a smooth and successful integration into the country’s business culture. Portage salarial, also known as an umbrella company, provides a unique system that allows freelancers to work independently while enjoying the benefits of being an employee.

When you choose portage salarial, a dedicated company acts as your employer, taking care of tax and administrative obligations, invoicing, and payments. This allows you to focus on your core business activities without the burden of complex paperwork and legal responsibilities.

Furthermore, portage salarial provides you with the security of employee status. You will receive a monthly salary, professional insurance coverage, and access to unemployment benefits. Additionally, you can contribute to the employee pension scheme and potentially benefit from an employment contract for housing or bank loans.

Not only does portage salarial simplify your business operations, but it also offers advantages over other business models like micro-enterprise status. It streamlines accounting, taxation, and social security contributions, ensuring that you comply with all relevant regulations. Whether you need to invoice before tax, gross salary, or net salary, portage salarial allows for flexibility while considering social security contributions.

The French health system, known as « assurance maladie » or Sécu, provides health insurance coverage to portage salarial workers through a social security health insurance system. Additionally, you can opt for a voluntary top-up health insurance scheme called Assurance Complémentaire to cover expenses not included in the social insurance coverage. This comprehensive coverage ensures that your health needs are taken care of, regardless of your citizenship.

When it comes to taxation, portage salarial simplifies the process. Tax residence is determined by agreements and conventions between France and your country of origin. French residents pay tax on worldwide income, while non-residents only pay tax on income earned in France. The income tax is deducted at source using a PAYE system, making your tax obligations transparent and efficient.

Expenses incurred for your business can be reimbursed by clients, and certain fixed and variable expenses can be deducted from invoices for tax and social charges purposes. This allows you to optimize your financial situation and minimize your tax liability.

In the event that your contract ends, portage salarial workers have access to unemployment benefits, providing a safety net during transitions between projects and ensuring financial stability.

Lastly, it is worth noting that the trade union for portage salarial negotiates national terms and conditions, ensuring that you receive the benefits of the collective agreement, further protecting your rights and providing fair working conditions.

With all these advantages, utilizing portage salarial as your business model in France offers a solid foundation for success. The support, assistance, and simplified processes provided by portage salarial companies will help you navigate the complexities of doing business in France, allowing you to focus on your expertise and thrive in the local business landscape.

FAQ

What is portage salarial?

Portage salarial, also known as an umbrella company, is a system in France that allows freelancers to work independently while enjoying the benefits of employee status. A portage salarial company acts as the employer, taking care of tax and administrative obligations, invoicing, and payments.

What are the benefits of portage salarial in France?

Portage salarial offers advantages over micro-enterprise status, simplifying accounting, taxation, and social security contributions. Workers receive their salaries monthly and are covered by professional insurance and unemployment insurance. They also contribute to the employee pension scheme and can benefit from an employment contract for housing or bank loans.

How does invoicing work in portage salarial?

Invoicing can be done before tax, gross salary, or net salary, and it is important to consider social security contributions in the calculation. The gross salary includes employee social contributions, while the net salary is the amount received after deductions.

What is the French health insurance system for portage salarial workers?

The French health system, known as « assurance maladie » or Sécu, provides health insurance coverage to workers through a social security health insurance system and a voluntary top-up health insurance scheme called Assurance Complémentaire. Workers can access the state health system regardless of citizenship. Additional health insurance policies can cover costs not covered by social insurance, such as deductible amounts or specialized treatments.

How does taxation work for portage salarial workers in France?

Tax residence is determined by agreements and conventions between France and the worker’s country of origin. French residents pay tax on worldwide income, while non-residents only pay tax on income earned in France. Income tax in France is deducted at source using a PAYE system. Expenses can be reimbursed by clients, and fixed and variable expenses can be deducted from invoices for tax and social charges purposes.

Are portage salarial workers eligible for unemployment benefits?

Yes, portage salarial workers have access to unemployment benefits when their contracts end. The trade union for portage salarial negotiates national terms and conditions, and workers are entitled to the benefits of the collective agreement.